Handelszeiten in Europa

-

-

ESAs publish first set of rules under DORA for ICT and third-party risk management and incident classification

ESAs publish first set of rules under DORA for ICT and third-party risk management and incident classification

The three European Supervisory Authorities (EBA, EIOPA and ESMA – the ESAs) published today the first set of final draft technical standards under the DORA aimed at enhancing the digital operational resilience of the EU financial sector by strengthening financial entities’ Information and Communication Technology (ICT) and third-party risk management and incident reporting frameworks.

The joint final draft technical standards include:

- Regulatory Technical Standards (RTS) on ICT risk management framework and on simplified ICT risk management framework;

- RTS on criteria for the classification of ICT-related incidents;

- RTS to specify the policy on ICT services supporting critical or important functions provided by ICT third-party service providers (TPPs); and

- Implementing Technical Standards (ITS) to establish the templates for the register of information.

RTS on ICT risk management framework and on simplified ICT risk management framework

The draft RTS on ICT risk management framework identify further elements related to ICT risk management with a view to harmonise tools, methods, processes and policies. These elements are complementary to those identified in DORA. The RTS identify the key elements that financial entities subject to the simplified regime and of lower scale, risk, size and complexity would need to have in place, setting out a simplified ICT risk management framework. The RTS ensure the ICT risk management requirements are harmonised among the different financial sectors.

RTS on criteria for the classification of ICT-related incidents

These RTS specify the criteria for the classification of major ICT-related incidents, the approach for the classification of major incidents, the materiality thresholds of each classification criterion, the criteria and materiality thresholds for determining significant cyber threats, the criteria for competent authorities to assess the relevance of incidents to competent authorities in other Member States and the details of the incidents to be shared in this regard. The RTS ensure a harmonised and simple process of classifying incident reports throughout the financial sector.

RTS on ICT TPP policy

These RTS specify parts of the governance arrangements, risk management and internal control framework that financial entities should have in place regarding the use of ICT third-party service providers. They aim to ensure financial entities remain in control of their operational risks, information security and business continuity throughout the life cycle of contractual arrangements with such ICT third-party service providers.

ITS on the register of information

Finally, the ITS set out the templates to be maintained and updated by financial entities in relation to their contractual arrangements with ICT third-party service providers. The register of information will play a crucial role in the ICT third-party risk management framework of the financial entities and will be used by competent authorities and ESAs in the context of supervising financial entities’ compliance with DORA and to designate critical ICT third-party service providers that will be subject to the DORA oversight regime.

Legal basis and Background

These final draft technical standards have been developed in accordance with Articles 15, 16(3), 18(3), 28(9) and 28(10) of DORA (Regulation (EU) 2022/2554). The public consultation on the draft technical standards took place from 19 June to 11 September 2023. The ESAs received more than 420 responses from market participants, including a joint response from ESAs’ stakeholder groups. The public consultation feedback led to specific changes to the technical standards, including ensuring simplification and streamlining of the requirements, greater proportionality and addressing sector-specific concerns.

Next steps

The final draft technical standards have been submitted to the European Commission, who will now start working on their review with the objective to adopt these first standards in the coming months.

Further information:

Cristina Bonillo

Senior Communications Officer

@ press@esma.europa.eu17/01/2024 JC 2023 83Final Report on draft RTS on classification of major incidents and significant cyber threats 17/01/2024 JC 2023 84Final report on draft RTS to specify the policy on ICT services supporting critical or important functions 17/01/2024 JC 2023 85Final report on draft ITS on Register of Information ESMA publishes latest edition of its newsletter

ESMA publishes latest edition of its newsletter

The European Securities and Markets Authority (ESMA), the EU’s financial markets regulator and supervisor, has today published its latest edition of the Spotlight on Markets Newsletter.

Your one-stop-shop in the world of EU financial markets focused in December on the European Securities and Markets Authority (ESMA) latest report on Cost and Performance of retail products. In this annual report, ESMA finds that the average costs of investing in key EU retail financial products has declined by the end of 2022. However, cost heterogeneity persisted across EU Member States.

In addition, ESMA is expected to launch its first Common Supervisory Action on ESG disclosures for Benchmarks Administrators. It is the first CSA for ESMA in its role as a direct supervisor of Benchmarks Administrators.

ESMA released several articles and studies:

- on making finance work for a sustainable future;

- on proposed changes and an updated timeline for ESMA’s Guidelines on funds’ names;

- on sustainable finance, and clarity and tips to consumers;

- on sustainability disclosures for the financial sector; and

- on cyber risk as a new Union Strategic Supervisory Priority.

Others:

- Draft technical standards under the revised ELTIF regulation published;

- ESMA consultation on draft guidelines for supervision of corporate sustainability information; and

- Climate risk stress testing and financial impact of greenwashing controversies

A full overview of all publications can be found in the newsletter, together with information on next month’s speaking appearances of ESMA staff and vacancies. For updates, follow us on Twitter and LinkedIn.

11/01/2024 ESMA NewsletterNewsletter November and December 2023 ESMA and NCAs to coordinate supervisory activities on MiFID II pre-trade controls

ESMA and NCAs to coordinate supervisory activities on MiFID II pre-trade controls

The European Securities and Markets Authority (ESMA), the EU’s financial markets regulator and supervisor, has launched a Common Supervisory Action (CSA) with National Competent Authorities (NCAs), with the objective of assessing the implementation of pre-trade controls (PTCs) by EU investment firms using algorithmic trading techniques.

PTCs are used by investment firms to carry out checks at order entry to limit and prevent sending erroneous orders for execution to trading venues. Following the May 2022 flash crash, ESMA and NCAs have focussed their attention on the implementation of PTCs in the EU, gathering evidence through questionnaires submitted to a sample of EU investment firms. As a follow up, ESMA and NCAs have decided to launch a CSA with the goal of gathering further and more detailed insights on how firms are using PTCs across the EU.

The CSA will cover the following aspects:

- Implementation of PTCs, including their calibration methodology and the use of hard and soft blocks in the design of PTCs;

- Establishment of credit and risk limits and their interaction with PTCs;

- Monitoring and governance framework related to PTCs;

- Implementation and monitoring of PTCs in case of outsourcing of trading activity to third countries.

This initiative and the related sharing of practices across NCAs aim at ensuring consistent application of EU rules, helping to promote stable and orderly markets in line with ESMA’s objectives. The rules governing the use of PTCs are set out in MiFID II and more specifically in CDR 2017/589 (RTS 6) which specifies the organisational requirements of investment firms engaged in algorithmic trading.

Next Steps

ESMA and NCAs will carry out the CSA in the course of 2024.

Further information:

Cristina Bonillo

Senior Communications Officer

@ press@esma.europa.euESMA explores risk exposures to real estate in EU securities markets and investment funds

ESMA explores risk exposures to real estate in EU securities markets and investment funds

The European Securities and Markets Authority (ESMA), the EU’s financial markets regulator and supervisor, is publishing its first analysis of the exposures the EU securities and markets and asset management sector have to real estate.

The analysis suggests that:

- Debt levels in the real estate sector are elevated with wider risk implications from non-bank financial market players.

- Interlinkages with the banking system are important and arise through entity exposures and activities. Through these, sector shocks may get transmitted across the EU financial system.

Going forward, interest rate risk can be expected to continue to shape real estate market exposures. Credit risk indicators for real estate companies have started to show signs of deterioration and liquidity mismatches remain a key vulnerability for real estate investment funds.

In the study, ESMA provides details of the evolution of this sector over the past five years. In particular:

- There has been a broad-based valuation decline of the main equity and bond real estate indices. Valuation declines were also observed for listed real estate firms and real estate investment trusts along with increased trading activity and securities lending activity for these market participants. Real estate-related securities are also found to be used as collateral.

- Leverage of real estate firms increased significantly over the past five years.

- Next to credit institutions, investment funds are important investors in the real estate sector. They also belong to the main counterparties of some real estate firms in derivatives and securities financing transactions.

Next steps

ESMA monitors financial markets on an on-going basis, in the interest of financial stability. Understanding the channels through which real estate markets affect financial markets and the wider economy is a key concern for policymakers and regulators.

Further information:

Aleksandra Bojanić

Senior Communications Officer

@ press@esma.europa.eu10/01/2024 ESMA50-524821-3038TRV Article: Real estate markets – risk exposures in EU securities markets and investment funds ESAs consult on draft implementing technical standards specifying certain tasks of collection bodies and certain functionalities of the European Single Access Point

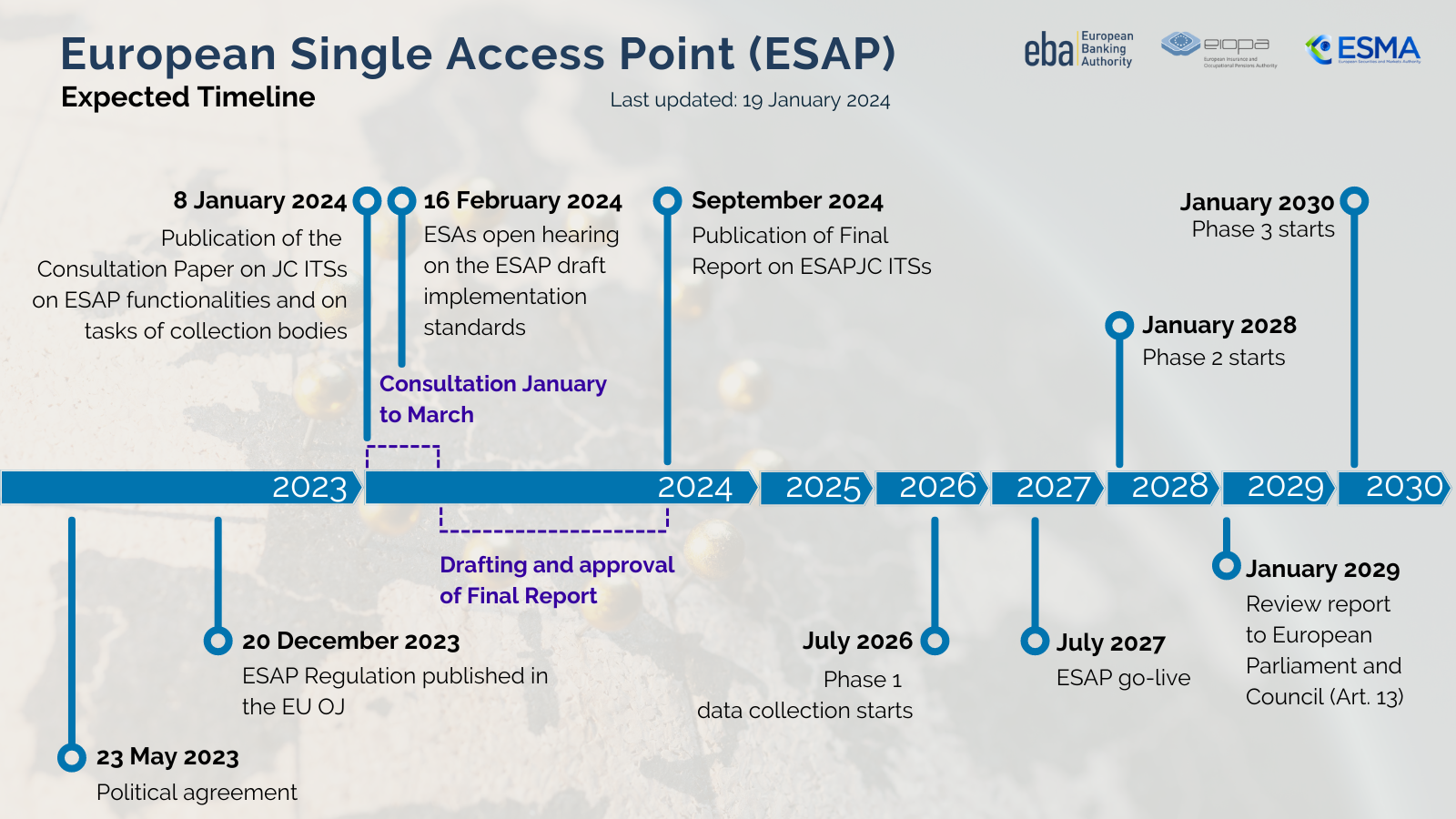

ESAs consult on draft implementing technical standards specifying certain tasks of collection bodies and certain functionalities of the European Single Access Point

The three European Supervisory Authorities (EBA, EIOPA and ESMA – the ESAs) today published a Consultation Paper on the draft implementing technical standards (ITSs) regarding the tasks of the collection bodies and the functionalities of the European Single Access Point (ESAP). These ITSs and the requirements they set out are designed to enable future users to be able to effectively harness the comprehensive financial and sustainability information centralised on the ESAP. Stakeholders are encouraged to provide their feedback to this consultation by 8 March 2024.

The purpose of this consultation is to give interested parties the opportunity to provide their views on the proposed rules with regard to:

- Tasks of collection bodies:

- automated validations to be performed on the information submitted by entities,

- the characteristics of the Qualified Electronic Seal,

- the open standard licenses to be applied,

- the characteristics of the data collection application programming interface (API),

- the characteristics of the metadata for the information,

- the time limits for providing the information to ESAP,

- the indicative list of formats that are acceptable as data extractable and as machine readable.

- Functionalities of the ESAP:

- the characteristics of the data publication API,

- the legal entity identifier to be used to identify the entities that submit the information or to which the information relates,

- the classification of the types of information,

- the categories for the size of the entities, and

- the characterization of industry sectors to classify the information contained in ESAP and allow users to search for it.

The establishment of the ESAP is a flagship action of the Capital Markets Union Action Plan. The purpose of the ESAP is to facilitate access to publicly available information of relevance to financial services, capital markets and sustainability. The ESAP is expected to become operational in July 2026 and will start publishing information no later than July 2027.

Consultation process

Comments on this consultation can be sent to the ESAs via the ESMA’s consultation page. The deadline for the submission for comments is 8 March 2024. All contributions received will be published following the end of the consultation, unless requested otherwise.

Public hearing

ESAs will organise a public hearing taking place on 16 February 2024 from 09:30 to 12:30 (Paris Time).

Next steps

The ESAs will consider the feedback received to this consultation and will submit the draft ITSs to the European Commission by 10 September 2024.

Further information:

Cristina Bonillo

Senior Communications Officer

@ press@esma.europa.eu

-